- Home

- Tools & insights

- Practical guidance for managing risk

- Minimising your exposure to insurable risk

On this page

- How to minimise your exposure to insurable risks

- What makes a risk insurable?

- Assessing your insurable risks

- Minimise your insurable risks

- Should you insure all your insurable risk?

- What are the benefits of minimising insurable risks?

- Always be ready to assess your insurable risk

- Maintain a register of indemnities and insurance

The Victorian Government Risk Management Framework (VGRMF) requires your organisation to work towards minimising your insurable risk.

This needs to be understood as a risk management proposition, rather than a question about insurance.

To minimise your exposure to insurable risk is simply to minimise your risk of loss and harm. It happens to be loss and harm of the kind that could be insured.

Whether or not it’s actually insured is a separate question, which we’ll touch on in this guide. If you want more information about optimising your insurance with VMIA, you can start with our guide on making a conscious decision about retaining and transferring financial risk.

How to minimise your exposure to insurable risks

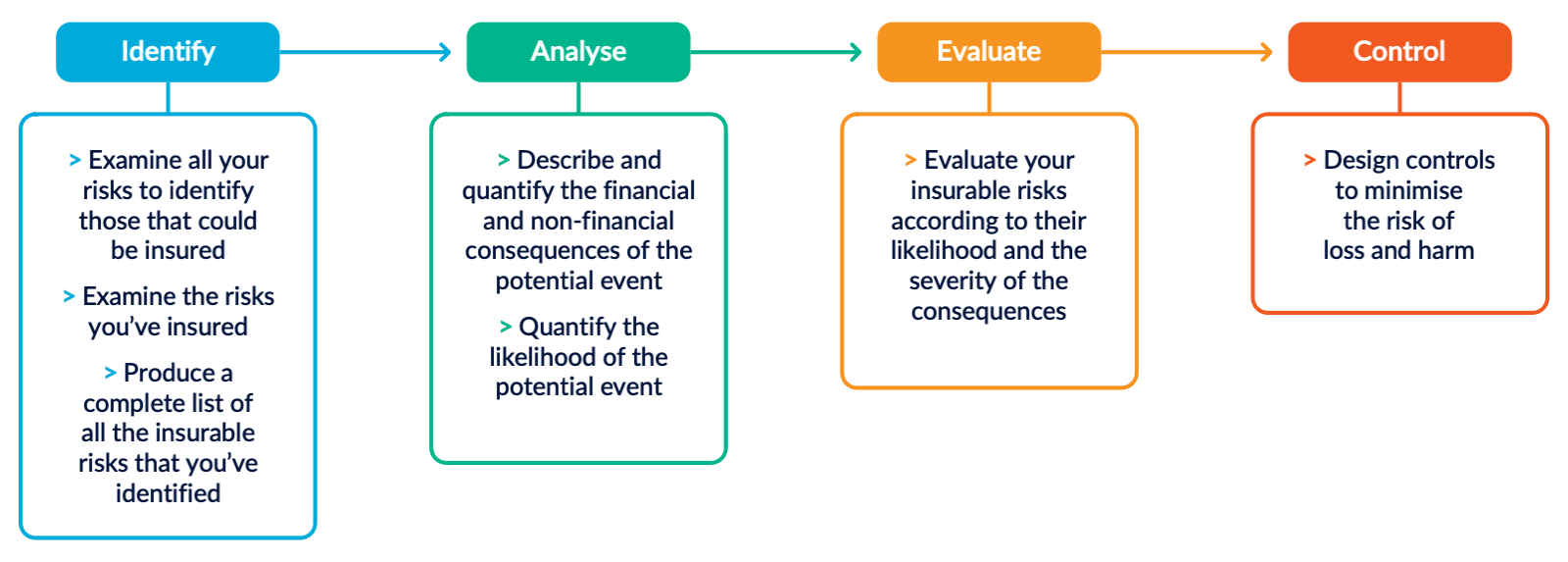

This is a standard process of risk assessment, focussed on a subset of risks—those that are insurable.

Your first task is to identify those risks. Once identified, you can analyse their consequences and likelihood, and evaluate them. From there, you can look at your options for minimising your exposure to them by using effective controls—which may include insurance.

What makes a risk insurable?

Insurance is a way of controlling the financial risks associated with events that cause loss and harm. To be more specific, it’s the risk that you’ll be faced with financial consequences that will prevent you from meeting your objectives.

Insurance is designed for events of loss or harm that happen by chance and which are beyond the control of the organisation. That could be

- loss or harm to physical and tangible assets

- losses and harm caused by an interruption to your business

- liabilities you have to third parties as a result of your organisation’s business activities

To decide how to cover your financial risk, VMIA needs to be able to

- calculate the likelihood of the loss or harm happening

- define and measure the loss or harm.

As part of the requirement to minimise your insurable risk, you need to understand what financial consequences you’re covered for in your policies.

In the next section, we’ll take you through a risk assessment process and show how, once you’ve identified your insurable risks, you can analyse those aspects of the risk that make them insurable, and then evaluate them.

Assessing your insurable risks

When you’re assessing insurable risks, you need to analyse those aspects of the risks that are meaningful to an insurer, as outlined in the previous section. This means more focus on rigorously quantifying likelihood and consequences of a potential event. It also means more attention on quantifying the potential financial consequences of that event.

-

Identify

Start by identifying potential events that could cause loss or harm to people, buildings, equipment, systems or the environment.

You may already know enough about insurance to identify which of those risks are insurable in the way we outlined above. If not, your insurance manager should be able to help you to identify them. You or your insurance manager can also reach out to VMIA for advice and assistance.

-

Analyse

For this step, you analyse the likelihood and consequences of your insurable risks.

For insurable risks, you’ll need to ask yourself detailed questions about the potential financial consequences of a likely scenario of loss or harm, and the worst case.

These would be questions like:

- What would it cost to

- repair and replace your own assets in those scenarios?

- repair and replace assets that belong to others?

- pay compensation to your staff and volunteers, or pay for their recovery?

- pay compensation to members of the public and people you provide services to, or pay for their recovery?

- What other costs would you need to cover as you work on repair and replacement?

- What other economic losses would you incur if operations were disrupted or a project delayed in those scenarios?

- What would be the opportunity costs of spending money on repair, replacement or compensation, rather than carrying out the organisation’s functions and activities?

- How likely is it that an event of those kinds described in the scenarios would cause these losses to happen?

To answer these questions, you’ll need to gather information from across the organisation, for example, the facilities manager or service delivery team. Depending on the risk and your remit, you may need to seek information from specialists outside the organisation. For example, to calculate the likelihood of fire over a specific period, you’d need specialists to do high-level research and analysis.

- What would it cost to

-

Evaluate

In evaluating the overall severity of the risk, consider both the financial and non-financial aspects of the risks. These consequences, whether they’re quantified or expressed in definite qualitative terms, still count in the evaluation.

Having a precise analysis of the financial consequences of risk will make a difference to how you evaluate the severity of potential consequences overall.

The likelihood of a risk is part of your evaluation, of course, and for insurable risks you may have quantified that with some precision—simply labelling them likely or unlikely isn’t enough for these risks. Make sure those calculations of likelihood align with the scale you use for risk evaluation.

As with a usual risk assessment, use these evaluations of severity and likelihood to give the risk a rating.

Don’t forget your insured risks

As part of the comprehensive assessment of your organisation’s insurable risks, it’ll be worth re-assessing the risks you’ve currently insured to make sure you have the appropriate level of insurance. To do this, you should start with your organisation’s insurance policies.

The insurance manager should work with the enterprise risk manager to

- identify, for each policy, the risks of loss and harm that you’re covered for, describing the risk in terms specific to your organisation

- analyse the financial and non-financial consequences of the potential event of loss or harm and their likelihood

- evaluate the risks associated with the event of loss and harm

Again, this is a standard risk assessment with a focus on financial consequences.

Minimise your insurable risks

Having identified your insurable risks, whether they’re insured or not—then analysed and evaluated them—you’ll have

- a better understanding of the consequences and likelihood of these potential events of loss and harm

- a quantification of the potential financial consequences

- a better understanding of the key risk indicators for that risk.

With this information, you can now work with risk managers, project managers and other decision-makers to control the risk of loss and harm so that it’s minimised as far as possible and reasonable, given your objectives.

Monitoring your key risk indicators will help you manage the risk appropriately over time.

You should also cross-check with your organisation’s risk appetite to see whether you’re operating within boundaries acceptable to your organisation’s responsible body.

The information about your risks and controls should be entered into your risk register and communicated to decision-makers and risk managers across the organisation, those you share risk with, and appropriate stakeholders.

Should you insure all your insurable risk?

It’s far better to control the risk of loss or harm. It not only minimises the risk of loss and harm associated with the event—which is a good in itself—it also reduces the risk of having to find money for repair, compensation and recovery. It’ll also help you reach your objectives, which is the whole point of risk management.

Having put in place controls to minimise insurable risk, your insurance manager and enterprise risk manager should work together to

- determine the appropriate insurance products and levels of cover for your controlled risks

- investigate how you can optimise the balance between financial risks that you retain, and those that you transfer to VMIA

- put in place adequate arrangements to manage claims relating to the retained financial risks

By minimising your insurable risks first, you’ll make sure all these risk management activities are the most effective at helping you achieve your objectives and are cost-effective.

VMIA can work with you to determine the appropriate insurance and to investigate your options for optimising your risk transfer, and discuss what counts as adequate claims management.

Read our guides and get in touch with your risk adviser to talk about how we can support you.

What are the benefits of minimising insurable risks?

We’ve outlined the benefits as we’ve unpacked how you minimise insurable risk. To sum up

- the people, places and systems in our care suffer less harm and loss

- you’ll minimise the number of claims

- VMIA will strengthen its position as a buyer in a changeable reinsurance market so that we can continue to provide cover to our clients at a lower cost than the market

- your efforts to minimise insurable risk will have a positive impact on premium calculations and cost of liabilities.

Always be ready to assess your insurable risk

Insurable risk, like all risk, is dynamic, which is why you need to invest time and resources into identifying and monitoring key risk indicators.

It also means you may need to re-assess your insurance requirements when there’s a change in your internal or external context, for example,

- the size and structure of your organisation have changed

- your functions and activities have changed, or how you carry them out

- you’re starting a significant new project

- you’ve purchased assets that are a significant addition to your organisation because of their cost or because of the size and type of your organisation

- the risk appetite of your responsible body changes

Maintain a register of indemnities and insurance

An indemnity is a form of risk transfer where one party agrees to pay for potential losses or damages caused by another party. The terms of an indemnity can be broad and include both insurable and uninsurable risks.

If you intend to indemnify another party, you should consult your organisation’s legal representative on whether to accept the terms of the indemnity proposed for a contract, and also on any legal risks associated with indemnifying the other party.

If you accept an indemnity clause, you’ll need to update your register of indemnities and insurances. If, due to adding an indemnity, you’ve changed your insurance, you’ll also need to update the insurance information in the register too.

Information in this register should be available to managers in your organisation and to VMIA on request.

When you’re dealing with another organisation insured by VMIA, we recommend that you don’t include indemnity or insurance clauses in your contracts—simply because they’re already covered by us. To find out if another organisation is also insured by us, contact VMIA at contact@vmia.vic.gov.au

Go to our website to find out more about dealing with different third parties and advice on indemnities.