On this page

Frequently asked questions

Clients are asked to complete the Renewal Risk Information (RRI) questionnaire each year to capture updated information on their risk profile, exposures, and activities for the purpose of underwriting and calculating future insurance premiums in accordance with reinsurers.

Providing accurate and updated information enables VMIA and its reinsurers to identify any changes in an organisation’s operations, assets, and potential hazards that might affect coverage, allowing for adjustments as required for adequate protection and compliance. Each client’s RRI questionnaire will vary and reflects their respective and active policies including key risk information required to be updated.

Only the active contact with the designated ‘Renewal Coordinator’ contact role type can access the RRI for completion. To change or otherwise manage contacts for the organisation, please refer to Managing contacts in portal

A good start is to visit our portal help centre for general tips and also read Getting started.

The VMIA portal won’t accept copied or saved usernames, passwords or other text data. If you have trouble logging in, follow these steps:

- Clear your cache and browser history

- Open an incognito internet browser tab (chrome preferred)

- Manually type in your username and password

Only in specific circumstances can we extend the window to complete the RRI. If you require an extension to complete the RRI , please contact your Risk Adviser or email contact@vmia.vic.gov.au

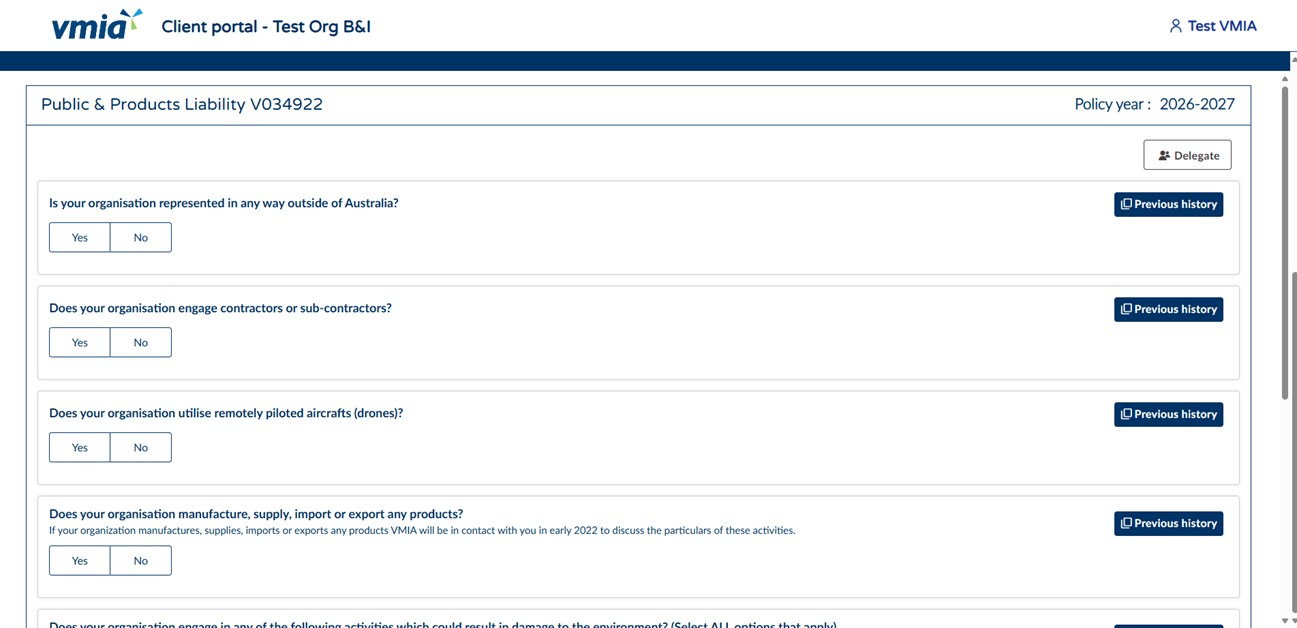

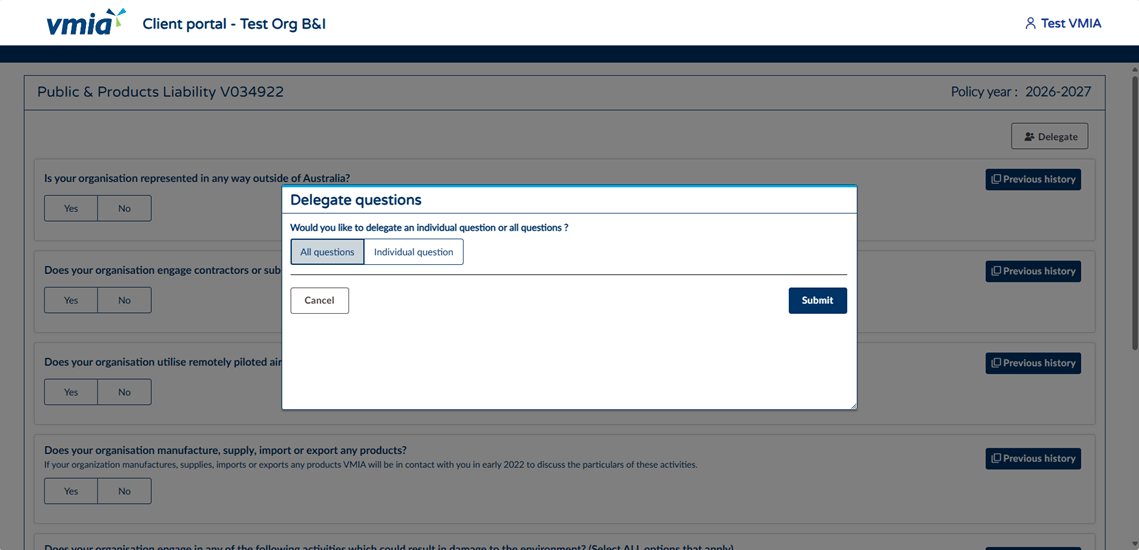

You may want to delegate question(s) in your Renewal Risk Information questionnaire to others within your organisation.

Following the steps below, the organisation’s contact with Admin and/or Head of Organisation access can designate authority for delegation purposes:

- Delegate questions to those that already have portal access. You only need to give them the additional account type “Delegated Restricted Access” (DRA) so they can see the question(s) assigned to them.

- Download a pdf version of the RRI questionnaire and email to those within your organisation who can provide the information you need. Type their responses into the RRI questionnaire in the portal on their behalf.

If you need to delegate question(s) to contacts without portal access, or who are not contacts in the portal at all, we provide the following instructions, respectively:

- Assign portal access to the required contact and designated “Delegated Restricted Access” (DRA) to their account upon updating the level of access that the individual has as well as, remove all other account types from their profile, otherwise they will be able to view all information contained in the portal as well as the RRI question(s) - Please Note: Admin access is required to update contacts for the organisation.

- When the delegated contact has answered the required question(s), the portal admin contact must arrange for portal access to be turned off for the delegated contact, and their original account types reinstated.

Please note: Only Portal Administrators can add, update and remove contacts in the VMIA portal.

You can learn more on our portal help centre under Managing user permissions.

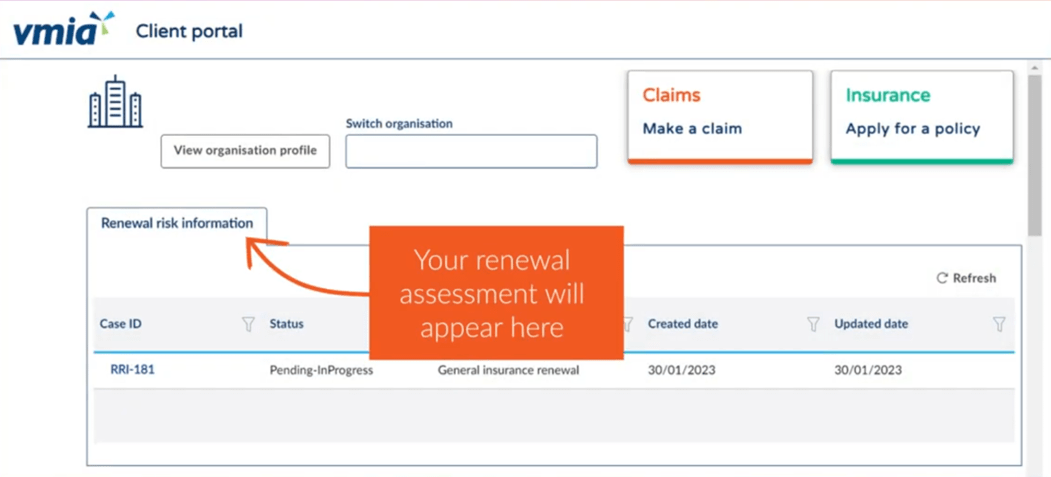

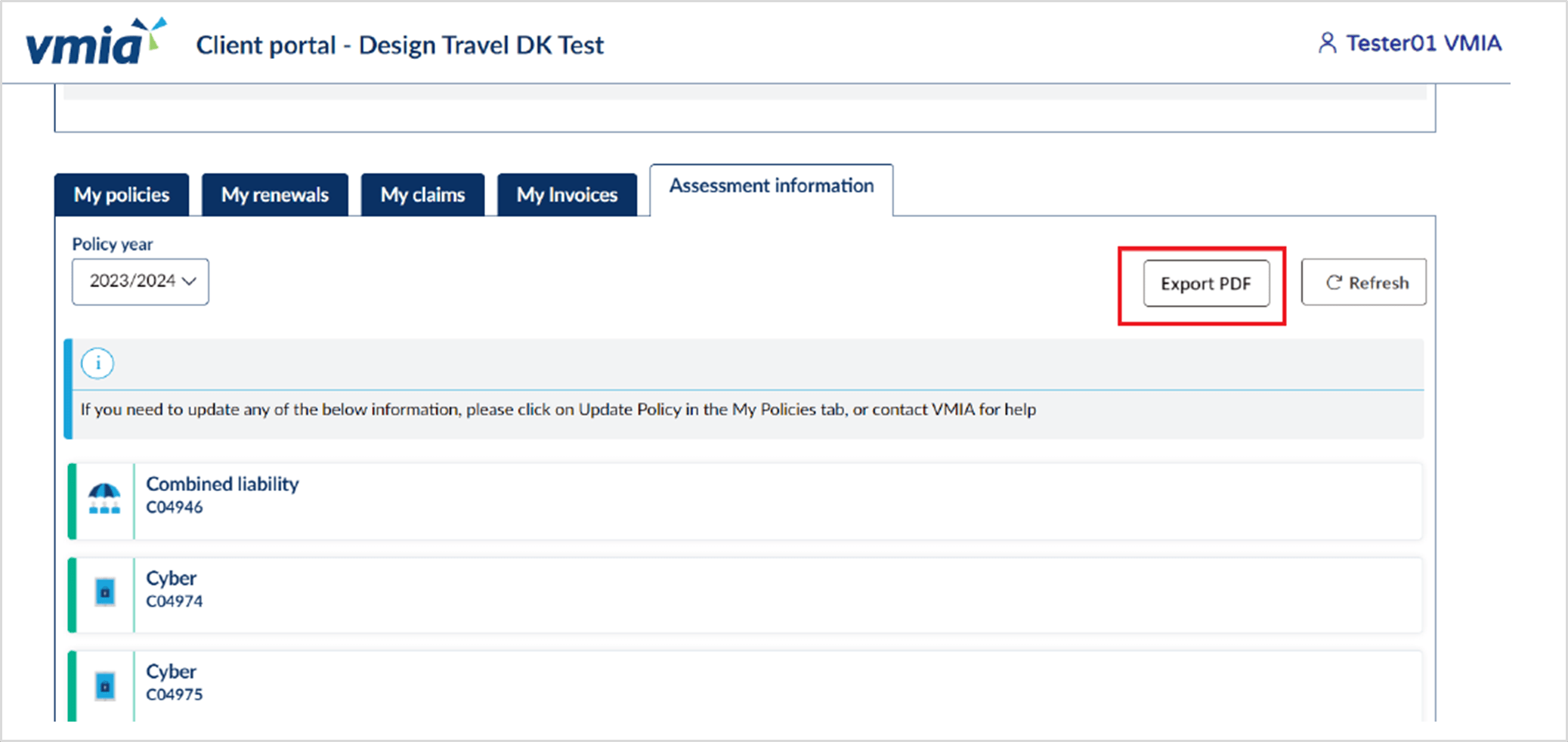

To see your RRI responses from previous years:

- Login to the VMIA portal

- Select ‘Assessment Information’ tab

- Choose the past policy year required

- Select ‘Export to PDF’ to generate a copy of responses for that policy year RRI.

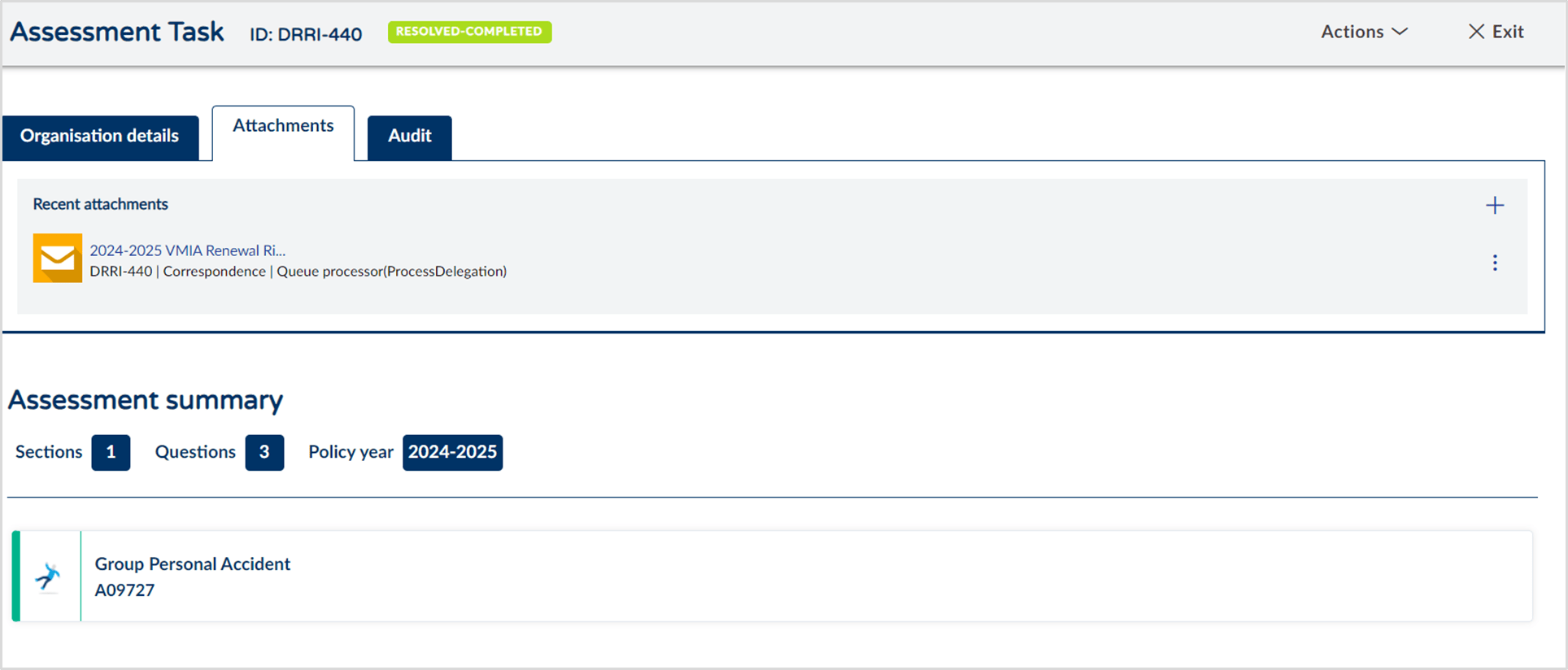

Attachments can be added to the RRI via the ‘Attachments’ tab at the top of the assessment.

Simply click on the ‘+’ icon on the right-hand side of the screen to attach any relevant documents. Make sure the document name indicates which product they relate to, for example “Public liability”

Note: You can’t remove attachments once added. Only add attachments where required and necessary. If unsure, contact VMIA your Risk Adviser for assistanceIf your answer to a question has triggered a potential underwriting review, it will be referred back to your Risk Adviser to better understand the risk information provided.

Your Risk Adviser may contact you via phone or email to discuss further. Once approved, the RRI will be issued back to you through the portal so you can finalise and submit.

Yes, a Risk Adviser will contact you to discuss the referral. Once approved, the RRI will be open for you to continue to complete and submit in the portal.

Should you require support, please contact your Risk Adviser contact. If unsure, please call us on 03 9270 6990 or email contact@vmia.vic.gov.au for help to complete your RRI questionnaire

Organisation Section

The answer to this question must be a whole number based on the calculation of what constitutes what a full-time employee (FTE) or equivalent full-time employee would be.

A full-time employee is, for a calendar month, an employee employed on average at least 30 hours of service per week, or 130 hours of service per month. The Australian Bureau of Statistics (ABS) considers 35+ hours per week full-time. Part-time employment is usually 1 - 34 hours per week.

Please do not include any commas, full stops or other notations outside of a whole number.

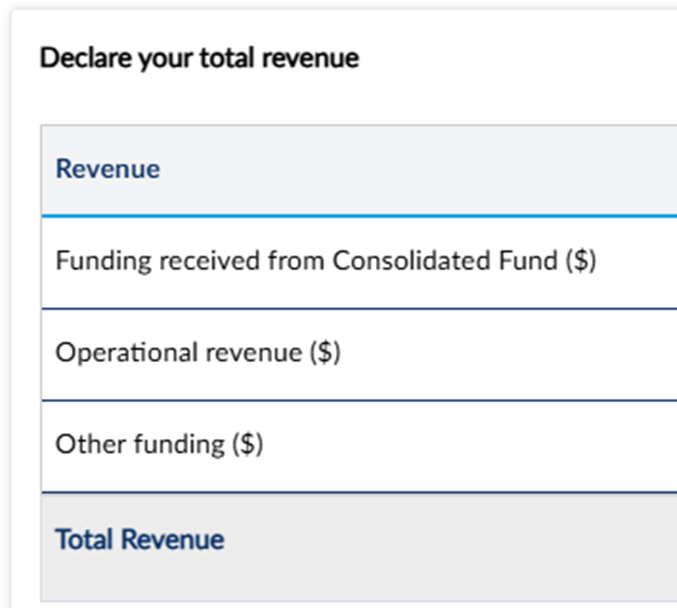

‘Funding received from Consolidated Fund’ refers to money or funding provided by the Department of Treasury and Finance, and/or other funding received specifically from the Victorian Government.

‘Operating revenue $’ refers to the money an Organisation generates from its business activities.

‘Other funding $’ refers to any private donations, funds and/or grants received from entities outside the Victorian Government.

‘Total Revenue’ is the total money a business earns before taking out any costs or expenses. This is not the same as ‘Gross Profit’ which is what’s left after subtracting the cost of goods sold (or services provided) from the gross revenue.

Example:

- If a business earns $100,000 in sales (Total Revenue)

- And spends $60,000 on Products or Services

- Then the gross profit is $40,000

Please only enter the figure related to ‘Total Revenue’ and not ‘Gross Profit’.

The Consolidated Fund refers to money/funding provided by the Department of Treasury and Finance, where all revenues, taxes, and other income are collected such as, funding, grants, and/or other money organisations specifically receive from the Victorian Government.

Operating revenue refers to the money an Organisation generates from its business activities.

Other fundings refers to any private donations, funds and/or grants received from entities outside the Victorian Government.

Combined Liability Section

This information is required to identify potential risk exposures your organisation may have if operating outside Australia or the State of Victoria. Your business activities overseas or interstate could include contractual agreements, a subsidiary, sale of a product or hiring a labour force, or conducting information seminars in foreign countries.

Examples of potential risks include:

- Legal and regulatory issues (e.g. different laws or compliance requirements)

- Personal Injury claims in foreign countries

- Product liability claims in foreign markets

- Employment disputes with overseas or interstate workers

- Political or economic instability in other regions

- Supply chain disruptions due to distance or local conditions.

Some of these risks may or may not be covered VMIA’s Combined Liability policy, and VMIA encourages clients to speak to their respective Risk Adviser to determine if there are any gaps in cover which may arise from work or operations performed overseas.

A contractor is a person or business who works directly with a client to execute a job, offer a service, or deliver materials. Usually a legal agreement will be in place outlining the terms of the contract and what each parties rights and obligations are under that contract. Often, there are insurance clauses within these agreements which spell out which party is required to take out insurance for either themselves or for both parties and the types of cover that needs to be in place. It is important that clients seek legal advice on their obligations under a contract and if there are concerns about insurance coverage, they should speak to their respective Risk Adviser.

Subcontractors are frequently hired by contractors for larger projects that require specialised expertise or extra resources. Similar to agreements between a client and a contractor, there may be important information regarding insurance arrangements for a particular contract.

Labour hire services refer to workers who are directly employed by an agency which then ‘on- hires’ to perform labour for a different employer. The first company is responsible for payment and other employee entitlements. The second employer, usually called the ‘host-employer’, directs the worker’s tasks.

VMIA clients are frequently exposed to labour-hire liability risks. When a labour-hire worker is injured in the course of their duties, they may be entitled to WorkCover benefits. In Victoria, such workers can also pursue a WorkCover common law claim as part of their broader entitlements. Importantly, a labour-hire worker may seek compensation from both the host employer and their direct employer. In some instances, the host employer may bear a greater proportion of the compensation, and these claims may be covered under the Combined Liability policy issued by VMIA. For this reason, it is essential to notify VMIA of the number of labour-hire workers engaged, to ensure appropriate risk assessment and coverage.

The TGA regulates therapeutic goods to ensure they are of high quality, safe to use and work as intended. The TGA administers the Therapeutic Goods Act 1989 (the Act) which sets out requirements and obligations for the supply, import, export, manufacture and advertising of therapeutic goods.

Therapeutic goods generally fall under three main categories:

- Medicines - including prescription, over the counter and complementary medicines, such as paracetamol and echinacea

- Biologicals - something made from or containing human cells or tissues, such as human stem cells or skin

- Medical devices - including instruments, implants and appliances, such as pacemakers and sterile bandages

For more information go to www.tga.gov.au

If a VMIA client is importing or exporting goods, there are certain risk factors which come with those activities. Notifying VMIA of these activities will help us tailor our pricing and product features to ensure that clients on not unconsciously covered. If a VMIA client is engaged in these types of activities, please contact your Risk Adviser to discuss insurance arrangements including the export of any therapeutic goods overseas.

Business Travel Section

This is a standard exclusion under the travel policy. We may be able to accommodate travel exceeding 180 days in some instances, but these will be reviewed on a case-by-case basis. We can also explore options that depending on the individual circumstances may be more suitable such as Expatriate cover.

This is a standard exclusion under the travel policy.

VMIA is guided by travel advisories issued by the Department of Foreign Affairs and Trade (DFAT). If a client makes a claim for losses incurred while travelling to a high-risk country, the claim may be excluded if DFAT has issued a ‘Do Not Travel’ or ‘Reconsider Your Need to Travel’ warning for that destination.

If clients are uncertain about their coverage, or require insurance for travel to a high-risk country, VMIA strongly encourages them to consult their respective risk adviser to discuss their specific circumstances.

Motor Fleet Section

The biggest difference between a trailer and a semi-trailer is: a trailer has a front axle, but a semi- trailer depends upon support and movement from the vehicle it has been attached to when going down the road.

An articulated vehicle is one that consists of two or more separate frames connected by suitable couplings. A truck tractor is a motor vehicle designed primarily for drawing truck trailers and constructed to carry part of the weight and load of a semi-trailer.

Generally, a hired-in vehicle will be for a few days or weeks to supplement a shortfall in available vehicles, or to replace a vehicle temporarily out of action. Hire arrangements for over a month or more could possibly be considered a long-term hire. Any hire for a period longer than one month should be declared for consideration of cover and potential premium adjustment.

The Code sets out the technical instructions for safely transporting dangerous goods by road and rail. The ADG Code uses the globally harmonised structure, definitions, and hazard classes set by the United Nations and is an important reference in Australian Work Health and Safety Act and Regulations.

It is important that everyone involved in transporting dangerous goods understands their responsibilities to help prevent and reduce damage to people, property and the environment.

If you require further information, please visit www.infrastructure.gov.au(opens in a new window)

Its objective is to provide a uniform basis for Commonwealth, State and Territory legislation governing the transport of explosives and it is designed to apply to all road and rail transport in Australia. This Code is applicable to civilian and military explosives transport. This Code does not apply to the transport of explosives by air or by sea.

If you require further information, please visit www.safeworkaustralia.gov.au(opens in a new window)

Group Personal Accident

Work experience is the short-term placement of secondary school students with employers to provide them with insights into industry and the workplace.

Practical work placement involves working at an established organisation in the role you're studying to become qualified for, or at least in a very similar role.

Property

Business Interruption (BI) insurance helps protect a business from losing income after a covered event disrupts operations. It is designed to support the business financially during the recovery period, helping cover ongoing expenses and lost profits.

Not all business interruptions are caused by physical damage to an insured property. Some financial losses can arise from other types of disruptions. Examples include:

- A nearby property damage blocks access to your premises.

- A public safety threat (without actual damage to your property) restricts access to your premises.

- A public authority shuts down your premises due to health or hygiene risks. Government-mandated closures due to insured events (e.g. safety concerns)

- There’s damage to your key suppliers’ or customers’ premises that disrupts your business.

Gross Revenue- Loss is calculated as follows:

- First you need to estimate what the business would have earned if the disruption hadn’t happened (Standard Gross Revenue)

- Second, determine what the business earned during the affected period. (Gross Revenue during Indemnity period)

- Third, add the extra costs incurred during the Indemnity Period, but only if they help reduce the loss in Gross Revenue. (Increased Cost of Working or ICOW)

- Finally, subtract any costs or expenses that were saved during the Indemnity Period because of the damage.

Basic Business Interruption Loss (BI) Formula

(Standard Gross Revenue − Gross Revenue during Indemnity period)

+ Increased Cost of Working (ICOW)

− Savings in Expenses due to the Damage

= Business LossAdditional Increase in Costs of Working

VMIA will reimburse the Insured for any extra costs (not already covered), including hiring temporary staff, that are reasonably and necessarily spent during the Indemnity Period due to damage to the Insured Property. These costs must be for the purpose of avoiding or reducing the loss of Gross Revenue or helping the business return to normal operations.

Gross revenue

Gross revenue is the total revenue generated by a business without deducting expenses and losses.

Annual Gross Revenue is the Gross Revenue earned during the twelve months immediately before the date of the Damage.

Indemnity period

The period starts from the damage and lasts up to the number of months stated in the policy, during which the business is impacted.

Medical Indemnity

VMIA regularly reviews and updates the RRI questions to ensure we are capturing the most relevant and current information about the risks faced by health services. The new questions help us understand emerging trends and changes in your clinical practice and ensures our understanding of your operations and organisational context remains current.

This year, some of the new questions focus on clinical trials and research activities, while others seek more detailed information about your organisation’s medical services and organisational operations.

Understanding any significant changes to your health service—such as mergers, new clinical services, facility expansions, or anticipated developments like new programs or increased telehealth—helps us accurately assess your current risk profile. This ensures your Medical Indemnity cover and risk advice remain relevant and tailored to your organisation’s evolving needs.

Your responses will support VMIA in providing more accurate Medical Indemnity cover and tailored risk advice, as well as to develop insights that support safer, high-quality patient care across the sector.

If you have any questions about the RRI, please contact your Risk Adviser.

Updated